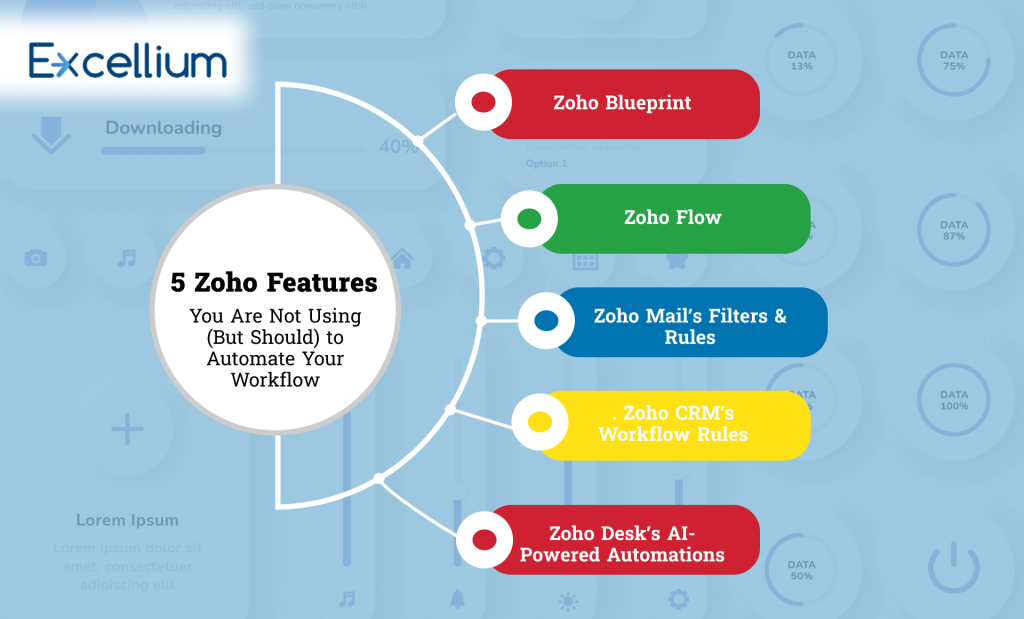

Let’s be honest: your HR team wasn’t hired to chase signatures or dig through mountains of physical and digital folders. Their mission is to nurture talent, build culture, and drive your most valuable asset – your people. But if you look around many Nigerian offices today, that’s exactly what’s happening. Someone’s asking for a contract edit – again. Leave requests are buried deep in WhatsApp chats and email threads. That critical exit letter? Still pending, delaying final settlement. And your HR team? They’re perpetually drowning in administrative quicksand. This isn’t a headcount problem. It’s a systems problem. Your talented HR professionals are being held back by manual processes that create bottlenecks, frustrate employees, and hinder strategic growth. At Excellium, we’ve witnessed this struggle firsthand. We’ve helped numerous Nigerian teams shift from constant burnout and reactive chaos to clarity, efficiency, and a focus on what truly matters. Here’s what’s really weighing your HR team down – and how the strategic implementation of HR automation changes everything. The Daily Grind: What “Manual HR” Actually Looks Like If any of these scenarios feel painfully familiar, you’re not alone. These are the hallmarks of a manual HR operation that’s stretched thin and risking costly errors: Employee updates scattered across three different tools: Imagine trying to get a complete picture of an employee when their personal details are in one spreadsheet, their leave history in another, and their training records in a third. This leads to inconsistencies and endless reconciliation. Performance reviews were delayed because someone didn’t fill out their form: The entire performance management cycle grinds to a halt, impacting employee development, engagement, and ultimately, organizational productivity. Recruiters juggling Excel, WhatsApp, and endless inbox threads: From candidate tracking to interview scheduling and feedback collection, a manual recruitment process is chaotic, slow, and prone to losing promising talent. Salary adjustments passed through email, with no official record: This is a compliance nightmare, opening the door to disputes, errors, and a complete lack of an audit trail for critical financial changes. Reports that take days to compile – and are still incomplete: When managers need critical data on headcount, attrition, or employee demographics, HR is bogged down in manual data extraction, often delivering outdated or inaccurate insights. These aren’t just minor inefficiencies. They’re significant friction points that actively block organizational growth, erode employee morale, and ultimately frustrate your entire team. The Invisible Drain: What Manual HR is Really Costing You Manual HR doesn’t show up as a direct line item in your budget; you won’t see “Manual HR Cost” on your profit and loss statement. But make no mistake, it’s bleeding time, energy, and lost opportunity from your business every single day. Here’s a breakdown of these hidden, yet substantial, costs: Problematic Area The Hidden Cost to Your Business Endless Admin Hours Your HR team spends valuable hours on repetitive data entry, chasing approvals, and correcting errors. This means less time for strategic initiatives, employee development, culture building, and genuine people support. It’s a missed opportunity for HR to be a true business partner. Lost Documents or Approvals Misplaced physical files or lost email trails lead to slower decisions, delays in critical processes (like onboarding or exits), and weaker compliance during audits or legal reviews. Onboarding Delays A slow, disorganized onboarding process due to manual paperwork creates a poor first impression for new hires, often leading to early disengagement and wasted productivity as they struggle to get started. Scattered Data Information spread across multiple, disconnected tools means there’s no single source of truth for employee data. This leads to inconsistent reporting, misinformed decisions, and compliance risks. Missed Performance Cycles When performance reviews are manual and cumbersome, they are often delayed or skipped entirely. This results in stalled employee growth, reduced engagement, and a missed opportunity to align individual performance with company goals. The longer your HR processes remain manual, the harder it gets to scale your operations, attract top talent, and maintain a competitive edge in the Nigerian market. The Game Changer: What Automation Fixes — Instantly Let’s get specific. This is how HR automation turns the tide, transforming your HR department from an administrative burden to a strategic powerhouse: Manual HR Problem How Automation Provides an Instant Fix Leave requests stuck in inbox Automated approval workflows that run themselves, routing requests to the right manager and updating balances instantly, eliminating chasing. New hires waiting for documents Auto-generated onboarding packets and digital forms guide new hires seamlessly through paperwork, creating an excellent first impression and speeding up time-to-productivity. HR chasing employee info Self-service portals empower employees to update their own contact details, access payslips, apply for leave, and view company policies, reducing HR queries significantly. Missing or disorganized records Synced, searchable, and secure digital files ensure all employee data, documents, and interactions are stored in one central, accessible, and compliant location. Reports taking days to compile Real-time dashboards and automated reports are ready in minutes, providing immediate, accurate insights into headcount, attrition, performance, and more, enabling data-driven decisions. Crucially, automation doesn’t replace HR – it elevates it. It liberates your team from mundane tasks, giving them the space to focus on strategic initiatives like talent development, employee engagement, and fostering a thriving company culture. It allows HR to lead, not just manage. The Right Tools to Get It Done: Excellium’s Approach At Excellium, we understand that implementing HR technology isn’t a one-size-fits-all endeavor. We don’t just sell software; we help you choose and implement HR tools that precisely match your organization’s complexity and growth trajectory – ensuring you don’t overbuild or underdeliver. We focus on solutions that are robust, user-friendly, and proven to deliver results in the Nigerian business environment: Zoho People → This is an ideal all-in-one HRIS for lean and growing teams. It consolidates essential HR functions like leave management, performance tracking, onboarding workflows, and attendance management into a single, intuitive platform. It’s perfect for businesses seeking efficiency without overwhelming complexity. Enquest HCM → Built for growing organizations with more layered approvals, intricate